Clover Credit Card Processing Fees

Comparing Clover Credit Card Processing Fees with Other Payment Processing Solutions for Small Businesses

Understanding credit card processing fees is important for small businesses for a number of reasons:

Cost control: Knowing the fees associated with accepting credit card payments can help small businesses to budget for these costs and ensure that they are not overpaying for credit card processing services.

Price competitiveness: Understanding the fees charged by different payment processing providers can help small businesses to compare the costs of different solutions and choose the one that offers the best value for money.

Profit margins: Credit card processing fees can have a significant impact on a small business's profit margins, especially for businesses with low-profit-margin products or services. Understanding these costs can help small business owners to make informed decisions about pricing and product mix.

Compliance: Payment card industry (PCI) compliance is a mandatory requirement for businesses that accept credit card payments, and non-compliance can result in substantial fines. Understanding the fees associated with credit card processing can help small business owners to budget for these costs and ensure that they are compliant with industry regulations.

Flexibility: Understanding the fees associated with credit card processing can also help small business owners to identify opportunities to negotiate more favorable terms with their payment processing provider, such as lower fees or more flexible contract terms.

Understanding credit card processing fees is important for small businesses because it helps them to control costs, maintain price competitiveness, protect profit margins, comply with industry regulations, and be more flexible in their approach to accepting credit card payments.

A brief overview of the Clover credit card processing solution

Clover is a popular credit card processing solution for small businesses. It is provided by First Data, one of the largest payment processors in the world. The Clover system includes a variety of different products, including point-of-sale (POS) terminals, mobile card readers, and software solutions.

The Clover POS terminals are designed to be user-friendly and easy to use, and they offer a wide range of features, including the ability to process credit and debit card payments, accept mobile payments, and manage inventory. The terminals are also equipped with a high-resolution touchscreen display and a built-in printer, making them a versatile solution for businesses of all sizes.

The mobile card reader enables small businesses to process credit card payments on the go, using a smartphone or tablet. It can be used for transactions such as curbside pickup, at-home services, and outdoor events.

The software solutions that come with the Clover platform include a variety of features such as inventory management, customer management, reporting, and analytics. The system can be customized to meet the specific needs of each business and allows them to track sales, manage inventory, and create loyalty programs.

The Clover credit card processing solution is a comprehensive and versatile system that can help small businesses to accept payments, manage inventory, and analyze data. It is designed to be user-friendly, easy to set up and use, and customizable to suit the needs of each individual business.

Fees associated with Clover credit card processing

The fees associated with Clover credit card processing can vary depending on the specific product or service that is being used, as well as the merchant agreement that is in place. However, here is a general breakdown of some of the fees that are commonly associated with Clover credit card processing:

Transaction Fees: These are the fees charged for each credit card transaction that is processed through the Clover system. These fees typically include a percentage of the transaction amount and a fixed fee per transaction. The percentage rate and fixed fee can vary depending on the type of card that is being used (e.g. debit vs. credit) and the merchant's processing volume.

Monthly Fees: Some Clover products and services have a monthly fee associated with them, such as the monthly fee for using the Clover software solutions like inventory management, customer management, reporting, and analytics.

Equipment Costs: If a small business chooses to purchase a Clover POS terminal or mobile card reader, there will be an initial cost for the equipment. However, the costs can vary depending on the specific model and features that are selected.

PCI Compliance Fees: In addition to the above fees, businesses using Clover will also need to budget for the costs associated with complying with Payment Card Industry (PCI) regulations. These costs can include an annual PCI compliance fee, as well as any costs associated with achieving and maintaining PCI compliance.

It's important to note that fees and rates can vary depending on the merchant agreement that is in place, and it is recommended to check with the merchant provider for the most accurate and current information.

Comparison of Clover's fees with industry averages for small businesses:

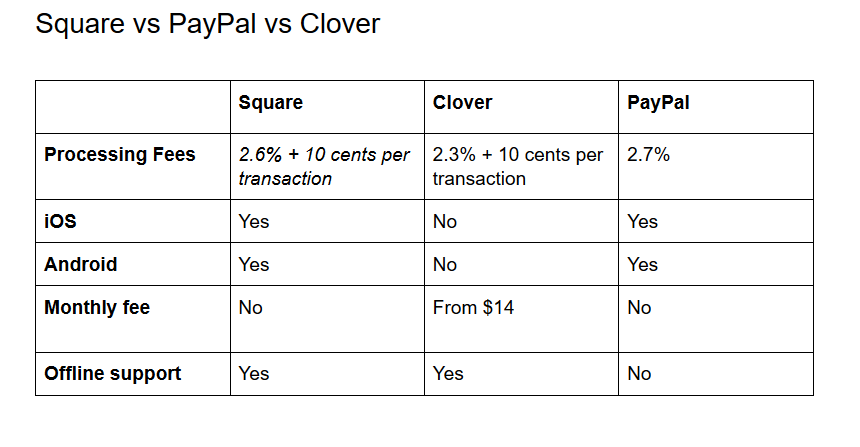

Comparing Clover's fees with industry averages for small businesses can be difficult, as fees can vary depending on a variety of factors such as the merchant agreement, processing volume, and the specific product or service that is being used. However, in general, Clover's fees are competitive with those of other popular payment processing solutions for small businesses.

On average, Clover's transaction fees tend to be slightly higher than those of other providers, typically around 2.3% + $0.10 per transaction. However, Clover's monthly fees are generally lower than those of other providers, with some plans starting as low as $9.95 per month.

Additionally, the costs of the Clover POS terminals and mobile card readers are generally comparable to those of other providers, with some models available for purchase or lease.

When comparing Clover's fees with industry averages, it's important to also consider the additional features and benefits that Clover offers, such as inventory management, customer management, reporting, and analytics. These features can provide small businesses with valuable insights and can help them to streamline their operations and increase efficiency, which can justify the slightly higher transaction fees.

It's also important to compare the costs of the different plans, as some plans may offer lower rates but with additional costs, like monthly, annual, or PCI compliance fees.

While Clover's fees may be slightly higher than some other providers, the comprehensive features offered by the system can provide small businesses with significant value. It's recommended to compare the fees and features of different payment processing solutions and choose the one that best fits the business needs and budget.

Any additional fees or hidden costs associated with using Clover

When using the Clover credit card processing solution, there may be additional fees or hidden costs that small businesses should be aware of.

Early termination fee: Some merchant agreements may include an early termination fee if a business decides to cancel its contract before the end of the term. This fee can be substantial and should be taken into account when considering a switch to another provider.

Monthly minimum fees: Some merchant agreements may include a monthly minimum fee, which is a set amount that a business must pay each month, regardless of how many transactions they process. This fee can be a significant cost for businesses with low processing volumes.

PCI compliance fees: All businesses that accept credit card payments are required to comply with Payment Card Industry (PCI) regulations. Compliance with these regulations can come with additional costs, such as an annual PCI compliance fee or the cost of a security assessment.

Interchange fees: These are fees that are imposed by the card networks, such as Visa and MasterCard, and are passed on to businesses through their merchant services provider. These fees can vary depending on the type of card being used and can be a significant cost for businesses that accept a lot of credit card payments.

Equipment Lease: Some businesses may opt for leasing their equipment instead of purchasing it, this type of agreement may come with additional costs, such as interest or lease termination fees.

It's important for small businesses to thoroughly review their merchant agreement and understand all the fees and costs associated with using the Clover credit card processing solution. This can help them to budget for these costs and ensure that they are not overpaying for credit card processing services. It's also a good idea to compare the fees and costs of different payment processing providers to ensure that they are getting the best value for their money.

Related Post :

%20v2.png)

Comments

Post a Comment